Amortization vs Depreciation YouTube

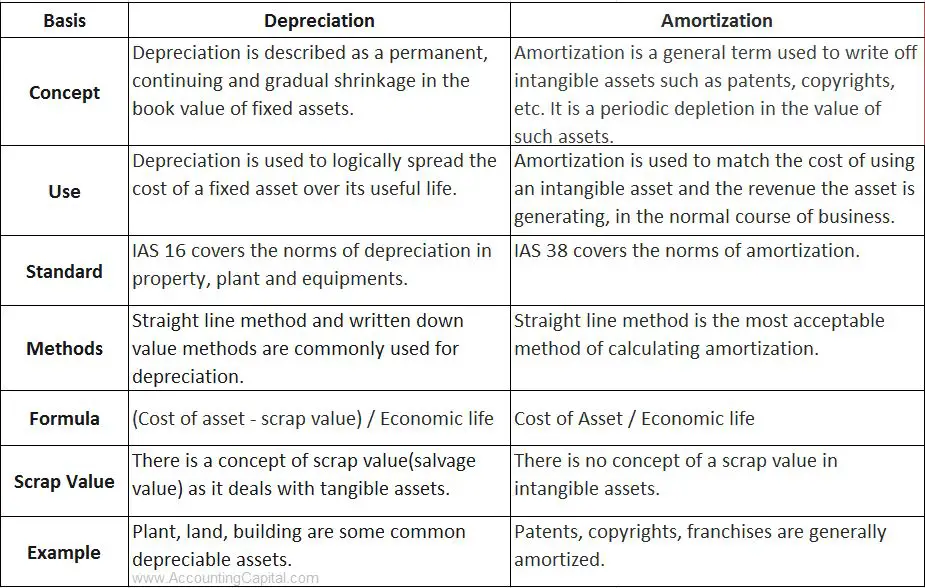

Now that we have examined depreciation and amortization in the context of leases, let's summarize the key differences between the two: Asset Type: Depreciation applies to tangible assets, while amortization applies to intangible assets. Nature of Decrease in Value: Depreciation accounts for the physical wear and tear or obsolescence of an.

Depreciation vs Amortization Difference and Comparison

Amortization is the method that is used to decrease the cost of the asset over time, while depreciation is the loss in value of the asset over time. This understanding helps in better understanding the financial implications of the purchase and saving time, effort, and money. The two calculations are important to calculate the tax liabilities.

Difference Between Depreciation and Amortization (with example)

Amortization and depreciation are the two main methods of calculating the value of these assets, with the key difference between the two methods involving the type of asset being expensed..

Depreciation vs Amortization Top 7 Best Differences (Infographics)

Depreciation is a measurable decrease in the value of a tangible asset from the time of purchase until the end of its usefulness. You might be most familiar with depreciation when it comes to buying a new car. What initially cost you $40,000 at the dealership may only be worth a fraction of that in months.

Amortization vs. Depreciation What's the Difference? YouTube

Depreciation is an accounting method used to track the loss of value in fixed assets such as vehicles, equipment, and buildings, spreading the cost of those items over multiple years. Depreciation Expense can be calculated by different methods including Straight Line, Declining Balance, Units of Activity, or Sum of the Years Digits.

Depreciation vs AmortizationDifference between depreciation and amortizationdepreciation YouTube

The key difference between amortization and depreciation is that amortization charges off the cost of an intangible asset, while depreciation does so for a tangible asset.

What is the Difference Between Amortization and Depreciation?

Depreciation and amortization are methods that determine the reduction or decline in the cost of tangible and intangible assets over a specific period. When buying property or investing in business-related assets, it's important to understand these two accounting concepts.

Amortization vs. Depreciation Key Differences

In simple words, a technique used to determine the loss in the value of the long-term fixed tangible asset due to usage, wear and tear, age or change in market conditions is known as depreciation. The depreciation is charged as a capital expenditure against the revenue generated from the asset during the year, i.e., the matching concept.

Difference between depreciation and amortization Example Journal Entries YouTube

Depreciation allows businesses to spread the cost of physical assets (such as a piece of machinery or a fleet of cars) over a period of years for accounting and tax purposes. There are several.

Depreciation vs. Amortization What's The Difference (With Table)

The major difference between the two terms is that depreciation is used for tangible assets, and amortization is used for intangible assets. Most business owners implement an amortization schedule to their income statement and work in tangible assets to show the depreciation expense of their company's physical assets.

:max_bytes(150000):strip_icc()/depreciation-depletion-and-amortization.asp-final-5c17abbe2ee24fd08ee04f121dea68c0.jpg)

Depreciation, Depletion, and Amortization (DD&A) Examples

There are four key differences between depreciation and amortization. Asset type: Depreciation is used to expense fixed, tangible assets, while amortization is used to expense intangible assets. Methodology: Depreciation can be calculated in several ways, while amortization is almost always calculated using the straight-line method.

Depreciation vs Amortization What is the Difference? in 2021 Learning, Different, Blog posts

The main difference between depreciation and amortization is that depreciation is used for tangible assets while amortization is used for intangible assets. In this article, you will also learn about: What Is the Meaning of Amortization? What Is the Meaning of Depreciation? How Does Amortization Affect a Balance Sheet?

Difference between depreciation and amortization in tabular form

The key difference between depreciation and amortization is the type of asset being depreciated or amortized. Depreciation is used for tangible assets, while amortization is used for intangible assets. Additionally, the useful life of an intangible asset is typically shorter than the useful life of a tangible asset.

Amortization vs. Depreciation, What's The Difference My Tax Hack

The concept of both depreciation and amortization is a tax method designed to spread out the cost of a business asset over the life of that asset. Business assets are property owned by a business that is expected to last more than a year. Amortization is used for non-physical assets called intangibles. Types of intangibles include:

What is the difference between depreciation and amortization?

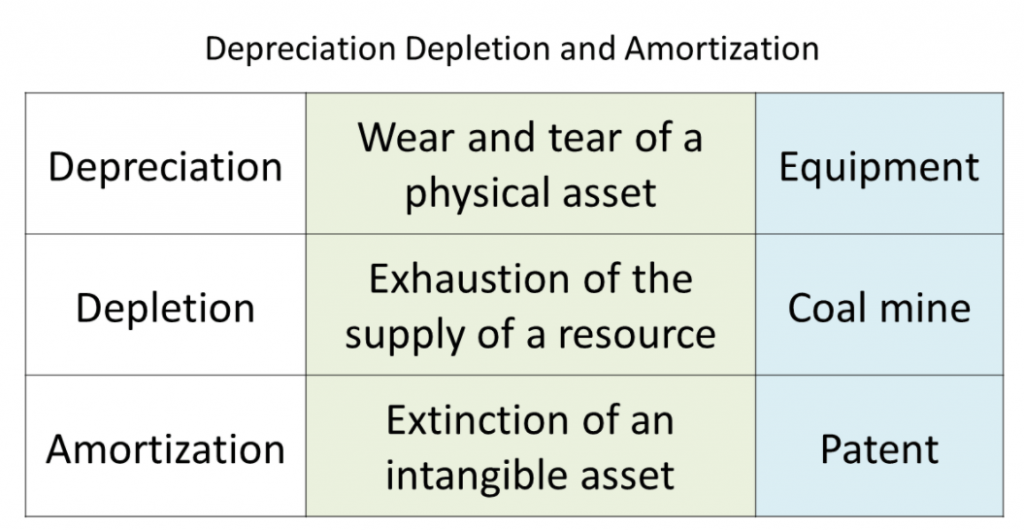

Depreciation, depletion, and amortization (DD&A) is an accounting technique that enables companies to gradually expense various different resources of economic value over time in order to match.

Difference Between Depreciation And Amortization(With Table) Differencify

This article describes the main difference between depreciation and amortization. Depreciation is for tangible fixed assets whereas amortization is for intangible assets, however, in a way they are similar yet different at the same time. We have compared depreciation and amortization in 5 distinct points below; Depreciation 1.